Tax season is in full swing. For many, this means tracking down receipts, looking for W-2s, and popping antacids like they’re candy. Even on a good day, filling out tax forms is a stress-filled, complex trip down a rabbit hole. However, the changes to the tax code aim to make filing more straightforward by eliminating a lot of deductions, so you may not have to track down those receipts after all.

As Bob Ross said, “There are no mistakes, only happy accidents.” While this may be true for painting beautiful landscapes, when it comes to your taxes, mistakes can cost you a lot of money. With knowledge and some proofreading, you can avoid making the following costly mistakes.

1. Not Putting Enough Money Away for Retirement

IRAs and 401(k) accounts are designed to help you save for retirement by allowing you to contribute to them up to a certain amount, tax-free. Contributing as much as you can not only give you more money when you retire, but you’ll also get a tax break on it now. For the 2023 tax year, the maximum amount those under 50 can put into a 401(k) is $22,500 and $6,500 for a Roth IRA; those figures are $22,500 and $7,500 respectively for people over 50. Whatever amount you contribute, you won’t pay taxes on it.

2. Forgetting to Include a Part-time Job

Maybe you took an extra job to earn money during the holidays. If that employer didn’t send you a W-2, don’t assume that you don’t have to pay taxes on the income. Track it down or you may find yourself being audited sometime down the road. If you did contractor-type work, it’s likely that you won’t receive a W-2.

3. Not Adjusting Your Withholdings

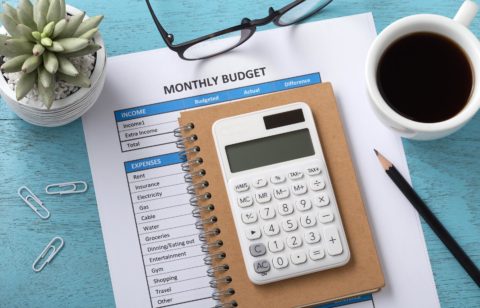

Many people prefer to get a refund at tax time, so they have the government withhold more than is necessary. This is like giving the U.S. government an interest-free loan. That money would be better off in an account that earns you interest, used to pay down credit card debt, or placed into a retirement account that saves on taxes.

4. Using the Wrong Filing Status

If you’re married, you can file jointly or separately. It may seem like it might save money to file separately and be in lower tax brackets. However, when you file jointly, you get to take advantage of certain tax credits that can save you a lot of money on your taxes.

5. Missing Deductions or Credits

There are new rules in the tax code every year. In 2018 personal exemptions were eliminated, as the standard deductions were raised. Things such as mortgage interest and vehicle registration fees can no longer be deducted. However, if you have children, a child in college, or medical expenses (among other things), then you still have access to quite a few deductions. It’s anticipated that because of the higher standard deduction, much fewer people will be itemizing. According to the IRS, 20% don’t claim the Earned Income Tax Credit, which could amount to as much as $6,341. It’s definitely worth your time to calculate what you could get by itemizing.

6. Doing Your Own Taxes

You’re 20 times more likely to make a mistake if you do your taxes on paper, says the IRS. Tax software is thorough, and the major programs offer online help if you have questions. Having a tax professional file your taxes for you might cost a bit more, but what you can save in taxes may be worth the extra cost. A tax professional can also give you some individualized tips on how you can save even more on next year’s taxes.

7. Filing or Paying Late

Filing after the April 15 deadline will cost 5% of owed taxes for each partial month you’re late, capping off at 25%. If you owe money and fail to pay, you’re penalized .5% of the taxes you owe for each partial month you’re late. Even if you can’t pay, be sure to file anyway. If you think you may be late, file for an extension.

8. Getting the Details Wrong

Check your return carefully for errors in the spelling of your name, your spouse’s name, and your dependents’ names, as well as for errors in the social security numbers for all, your address, and your bank information. These things probably won’t cost you money, but they can delay the process.

9. Entering Your Financial Information Incorrectly

The information and numbers on your W-2s and other tax forms related to income have been reported to the IRS, and that’s what its computers will be looking for when it receives your tax return.

When done right, you should be paying only the taxes for which you’re legally responsible. This is done by arming yourself with tax knowledge and implementing smart financial decision-making, such as investing in your retirement accounts and withholding only what’s necessary.

Before you go right out and make any major changes to your tax routine, it’s important to remember that we are not tax professionals and you should consult with one before proceeding with your taxes. However, these tips can help you to avoid mistakes and stay on top of your taxes this year and for years to come!

*The content provided here is for informational purposes only and should not be used for tax, legal, or accounting advice. Please consult your own tax professional before making any tax, legal, or accounting decisions.