While Jaime was supporting his dream to become a private pilot, his student loans and credit card debt became a nightmare. As Jaime recalls, “One of the things that got me into that was we are very disorganized. We like to spend, getting credit cards. The other thing was my studies. Doing a professional pilot program is very expensive, but I really wanted to do it. And besides that, (my wife) Karina started to do the same, getting credit cards.”

Jaime had already maxed out his cards when Covid hit, and his pending pilot role was put on hold. As Jaime describes, “I was taking money from one and putting it into the other one; it was a complete nightmare. I couldn’t sleep.”

Things get dark

Jaime paints this period in his life as very dark. He owed taxes, credit cards, loans, and student loans that were interfering with not only his finances but his marriage. As Jaime recalls, “There was a point that someday we won’t be able to continue to do the payments. Of course, you have economic problems, so your marital life starts to get into a hardship.

We had to move to a basement in New York because it was cheaper. But Karina didn’t like that basement. It’s dark and it’s not nice to live. So, I think our life was in big trouble with all the debt that we used to have.”

A friend’s advice goes a long way

A friend who once worked for National Debt Relief recommended the program after noticing their struggle. But Jaime was skeptical when Karina decided to try it, especially after his catastrophic experience with another company.

As Jaime explains, “I lost $1,200 with someone that promised I was going to get free of debt. So that was why I was very skeptical. But then, when I started to realize that it was true, I started to convince myself that I should enter the program.”

The contract seemed legit, and the service Karina received sealed the deal. As he recalls, “I remember once Karina had a collections paper from one of the credit cards and she was very scared. She called on National Debt Relief, and they helped her.”

Relief from the first call

When Jaime initially called National Debt Relief, the first step was going over his accounts. According to Jaime, “You really feel comfortable. You see that they’re helping you. And when that happened, I started to realize this is the right program for me.”

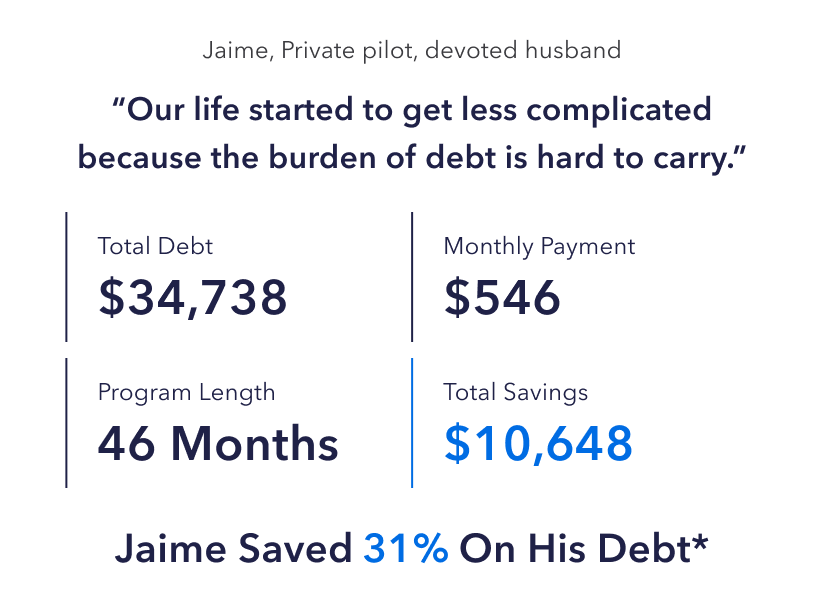

Jaime also appreciated how his Debt Coach kept him involved throughout the process. As he describes, “When they resolved the accounts, they showed me how much money I was saving. I remember that my first account was $5,000. They ended up with $1200 or $1300, I saved like $3000. And once when I skipped one or two months, in less than a five-minute call the person helped me resolve the issue.”

Jaime graduated from the program four months ago. After resolving his debt, he received a credit offer from a bank—which was a first for him. As he speculates, “I’m pretty sure that it was National Debt Relief who helped me get to that point. I used to apply for a bank credit card, and they always said no. I applied, and they approved me for more than $6,000 with no problem.”

From darkness to light

Jaime is living the dream and enjoying more control over his finances and his life. And he’s traveling—a lot.

As he describes, “We just came back from Cartagena last week on vacation. And last year we went to San Francisco and had a very good time.” Jaime and Karina fulfilled another dream. As Jaime explains, “We always dreamt to get a house here or in our country. Now we can afford to have one in Colombia and one here.”

Jaime was skeptical at first, but now he’s a believer. “When you don’t have that burden on you, it makes everything simpler. The expectation in the beginning for me was like being in the dark. And when I graduated, like wow. From night to day,” expressed Jaime.

Friendly advice

Jaime recommends NDR to anyone who is challenged with debt. As he advises, “Do not hesitate to contact NDR because they can really help you. They are interested in you and to resolve your problems. Not just another person, they get involved with you personally. They were more like friends trying to help us to resolve our debt problems.”

Let the people at National Debt Relief help you write your success story. We have supported over 1.2 million people nationwide every step of the way to help them resolve their debt, regain financial independence, and adjust their spending habits to remain debt free.