Business Debt Relief

- Business debt relief options can reduce monthly payments, consolidate loans, or settle debts.

- Debt impacts business owners’ finances and personal well-being.

- Relief options include debt consolidation, hardship loans, and alternative financing.

- National Debt Relief supports businesses in becoming debt-free with client-focused solutions.

As the saying goes, “You have to spend money to make money.” So, whether you are running a large or small business it is inevitable that you will rely on borrowed money at some point to boost profits and promote growth.

A tried-and-true method of managing business debt is to avoid adding expenses like interest costs, late payments, and other charges. While some businesses can solicit contributions from investors, many owners must provide their own funds, which is considered good debt.

Sometimes, however, you will start spending money that you just can’t seem to make back. This is when business debt stops being a factor of the business and starts becoming a problem. As a result, it is important to ensure that you don’t get in over your head by borrowing more than you can afford.

Free Consultation with a Certified Debt Specialist

Start with a Free No-Obligation Consultation

As the saying goes, “You have to spend money to make money.” So, whether you are running a large or small business it is inevitable that you will rely on borrowed money at some point to boost profits and promote growth.

A tried-and-true method of managing business debt is to avoid adding expenses like interest costs, late payments, and other charges. While some businesses can solicit contributions from investors, many owners must provide their own funds, which is considered good debt.

Sometimes, however, you will start spending money that you just can’t seem to make back. This is when business debt stops being a factor of the business and starts becoming a problem. As a result, it is important to ensure that you don’t get in over your head by borrowing more than you can afford.

Start Paying off Your Credit Card Debt Today!

Personal And Professional Effects Of Business Debt

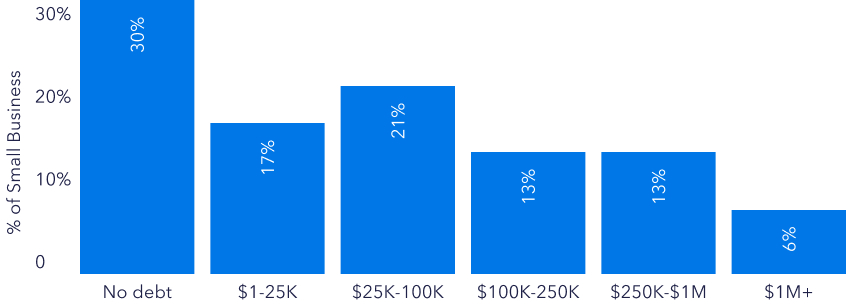

We did some digging to take the pulse of business owners. Our premise was how debt affected both their professional and personal lives. The following information is based on a National Debt Relief survey taken by 438 people with business debt.

Business debt is partly a business challenge:

- 24% say the debt has damaged their business

- 17% say debt forced them to close their business

The impact of debt also spills Over Into consumers’ personal lives:

- 46% claim that debt is impacting their ability to pay for a personal car or their rent

- 34% said they can no longer afford “extras” like restaurants and leisure activities

- 21% are delaying life events including marriage, children, or retirement

- 63% report business debt has caused increased personal stress

In addition:

- The average small business loan is $417,316, while the maximum loan amount is $5 million

- 33% of small business owners struggle or fail due to a lack of capital

Types Of Business Debt

Even if you put money away for your business, don’t be surprised if unexpected issues force you to seek additional funds. For instance, the air conditioning might conk out or your insurance payments could go through the roof.

If your small business is struggling to pay its bills, you might be looking for some debt relief advice. You are not alone: Each year, thousands of American small business owners find themselves in a sticky financial situation.

Some types of business debt that can take a chunk out of your bottom line include:

- Debt from startup costs

- Investing in growth and new business

- Debt owed after a business closes

- Slow season affecting business

- Cash flow issues to pay employees, suppliers, and creditors

- Purchasing costly business equipment

Options To Settle Your Business Debt

Business debt is just what the name says: any debt you take on for your business or LLC. There can be gray areas because if you use your personal computer for work, that falls under consumer debt. But debt from a company credit card is considered business debt.

Using a line of credit now and again might seem insignificant when it can positively impact the growth of your company. However, business debt can sneak up on you—especially when you start running behind on payments. That is when interest, late fees and other charges can push your debt over the top.

Companies often tighten their belt to trim costs. In most cases, they also rely on small business debt settlement to fix their bottom line.

Business Debt Consolidation Loans

Business debt consolidation is taking out a new loan to pay off multiple existing loans. It can save you money in the end by reducing the interest you pay on your new loan and avoiding late fees and overdrafts. You will also save time and hassle by keeping tabs on one monthly payment instead of juggling multiple creditors.

When you take out the loan, the debt consolidation company negotiates with the creditors on your behalf to pay off the original balances. You then pay the new consolidation loan’s balance over a longer period at a lower monthly payment.

Pros And Cons Of A Business Debt Consolidation Loan

Business debt consolidation isn’t for everyone. Let’s see if you should give it a go:

Pros:

- One major advantage to consolidating your debt is the potential to receive a lower interest rate and reduced monthly payment amount. You could end up saving hundreds or even thousands of dollars in the long run.

- If you have multiple loans, it can help you streamline your expenses to a single monthly amount and decrease the chance of missing one or multiple monthly payments.

- Your stress levels should level off. Instead of juggling many individual monthly payments, having one all-inclusive loan means only keeping track of one due date. If possible, set up autopay so that the money is automatically withdrawn from your business checking account.

- Since payment history is a big factor in credit scores, building up a track record of on-time payments could boost your number.

Cons.

- If one or more of your current outstanding loans has a prepayment penalty, it is important to factor in these fees when determining the amount to borrow.

- Consolidating debt does not guarantee you won’t find yourself back at square one.

- Some debt consolidation loans come with up-front costs and other fees.

- You may pay a higher rate.

- Missing payments will set you back even further.

- If you have poor credit, you probably won’t get approved for the loan.

- It can take a longer amount of time to pay off — a minimum of five years

- During this time, you will be charged monthly interest that may limit the amount of money you save. Since you are paying what you owe on your original loans (principal plus interest), you could end up paying more because of compound interest—even with a lower interest rate.

- Don’t consider this as a permanent solution. If there are deeper cash flow issues, a debt consolidation loan will only fix your current financial situation. It may give the temporary illusion that your business is on an upward trajectory. This could set you up for failure in the future.

Business Hardship Loans

If your small business is struggling, you can apply for a business hardship loan—also known as a business rescue loan. If you qualify, the Small Business Administration will provide an interest-free loan up to $35,000. The funds are meant to keep your business up and running by covering business debts and ongoing expenses.

Repayment is usually deferred for a year, but eligibility varies depending on the age and profitability of your company.

Hardship Payment Plan

If an account has fallen behind and you are trying to catch up on payments, you might qualify for a hardship payment plan. This is not a loan. What it does is reduce your monthly payment to a more affordable amount.

Small Business Bankruptcy For Debt Relief

If you have decided that bankruptcy is the only way out, you are not alone. Unfortunately, thousands of small business owners are forced to take this route every year. The pandemic accelerated that trend. Although there are plenty of reasons for you to continue fighting to avoid a potentially costly bankruptcy reorganization, there is also no shame in calling it quits.

There are two common forms of bankruptcy for small business owners: Chapter 11 and Chapter 13. Both offer small business owners a fresh start by enabling them to renegotiate the terms of their credit cards and unsecured loans. This process of creating more favorable terms is called debt restructuring.

In most cases, you will need to declare Chapter 11 bankruptcy. But if you are the sole employee of your small business and you have less than about $1.4 million in total debt, you are eligible to declare bankruptcy under Chapter 13.

Although both forms can have serious credit score consequences, these methods are designed to help business owners avoid a worst-case scenario of Chapter 7 bankruptcy.

When you declare bankruptcy, the presiding judge will work with you and your creditors to lay out a new strategy to honor your financial commitments. Once it is entered into the record, the negotiation process begins.

If your business is relatively large, this plan may involve selling off some of its non-core assets to cover your secured debts. For instance, you may be asked to sell equipment you no longer use or sell some storefront locations your company owns. In all likelihood, your business will exit the bankruptcy reorganization process as a smaller, leaner company.

When you file for Chapter 11 or Chapter 13 bankruptcy, it is highly unlikely your unsecured debts will be forgiven outright. Under the judge’s order, some of your creditors may agree to reduce the balances on your outstanding debt. Others might be willing to spread out your repayment term, which lowers the monthly payments.

These moves can take some of the pressure off and provide a chance for you to boost sales or find other streams of revenue.

The Downside To Filing Bankruptcy For Small Business Debt Relief

Many small business owners who successfully emerge from bankruptcy find themselves back at square one within a few years. This is because bankruptcy is highly detrimental to a participant’s credit score. Your personal credit profile might be protected by your organization’s status as a limited-liability corporation or other “shielded” business entity. But your business’ credit profile will be heavily marred if you use bankruptcy as the way out.

Once you emerge from bankruptcy, you could encounter a not-so-pleasant surprise: the cost of taking out new loans is no longer within reach. You will be charged higher interest rates and need to adhere to strict borrowing limits. Worse, some of your loan applications might be denied outright. It is hard to grow or even maintain a business under such conditions.

Small Business Debt Settlement

Some of your small business’ expenses may qualify for debt settlement. Eligibility might include personal credit cards that have been used for your business as well as certain unsecured business loans or lines of credit.

This process resembles restructuring, but it may have a gentler impact on your credit score. Like restructuring plans, debt settlement involves negotiating with unsecured creditors to reduce the amount you owe.

Although there is no such thing as a typical case, it may be possible to reduce your debt substantially with this method. Most debt settlement programs take less time to work through than debt consolidation. In fact, some business owners have used this method to settle their debts in just 24 months.

As a small business owner, you have plenty of financial choices at your disposal. Debt consolidation loans, debt restructuring, bankruptcy, and debt settlement to name a few. Before taking action that could affect the long-term viability of your business or your own personal finances, be sure to explore your options.

According to the Federal Reserve, Americans carry nearly $1.1 trillion in credit card debt, up from $888 billion five years ago. On average, consumers overspend $7,400 each year on categories like online shopping, groceries, and subscription services.

How National Debt Relief Works

With National Debt Relief’s programs, small business owners have a better chance of becoming debt free in as little as 24-48 months. You can also save substantially since our debt coaches often get the banks to forgive almost half of what is owed. Once you pay off credit card and other unsecured business debt, you can get back to working on reaching your business’ full potential.

In addition to paying off your debt faster and with the most savings, you can benefit from:

Why Should You Trust National Debt Relief? (Unemployment)

At the core of our client relationships is one simple factor: trust. We know that trusting anyone with your finances takes a leap of faith, and we live up to your expectations by providing our undivided attention. That way, we can better identify your goals and concerns before customizing an affordable plan that can save you the most money.

National Debt Relief is the first debt settlement company to be accredited by the Better Business Bureau with an A+ rating, the American Association for Debt Resolution, the Internal Association of Professional Debt Arbitrators, and rated #1 on Consumer Affairs. We are proud to be the country’s only debt relief provider to enjoy recognition from these three important organizations.

Our Commitment To Customer Care Leads The Industry

We will always act in your best interest and our reviews reflects that promise:

- Over 75,000 5-star reviews from clients who have taken back control of their finances

- 4.83 out of 5 rating on TrustPilot

- Rated #1 for debt consolidation by:

Here’s What Small Business Owners Need To Know

For new business owners who don’t yet have a proven track record, qualifying for a bank loan is out of the question. In addition to excellent personal and business credit, banks also require proof of revenue, healthy cash flow, and at least a few years of experience running your business. Banks usually prefer to lend to those looking for upwards of $1 million, a considerable amount for small businesses.

1. Is getting a loan your one and only option?

When you are just starting out, you might think that applying for a small business loan from traditional banks or credit unions is your only shot. But there are a host of other options.

A less traditional way to raise funds is from supporters. According to TRUIC Startup Savant, these are currently the best crowdfunding websites:

StartEngine – Best for :

Indiegogo – Best for :

Kickstarter – Best for :

Fundable – Best for :

SeedInvest – Best for :

CircleUp – Best for :

Patreon – Best for :

Wefunder – Best for :

IFundWomen – Best for :

GoFundMe – Best for :

Crowdcube – Best for :

MicroVentures – Best for :

Seedrs – Best for :

Mightycause – Best for :

2. What do you need the money for?

If you are seeking a loan, you probably have a good idea why you need the money. Perhaps you lack funds for employee paychecks, need to cover everyday costs or will soon be purchasing new supplies or equipment.

It is still important to jot everything down to see the big picture and determine if you have missed anything. This will also help you establish the amount you need to borrow. These two decisions go hand-in-hand.

3. Can I make the monthly payments?

Like any type of financing, you will pay monthly interest on a small business loan. Will this add to other debt you might have incurred, or can the repayments come out of your cash flow? If this will pile debt onto debt or cause you to tap into cash flow, it is time to seek other options.

While you can’t plan for an emergency, you can prepare in advance for one. If you are using your emergency fund to meet your monthly payments, you could feel the pinch if a real crisis arises. Words of advice: don’t do it!

4. What is alternative lending?

In addition to traditional creditors, another option is borrowing from a small business alternative lender. This refers to any lending practice that occurs outside a traditional bank. Alternative lending connects business owners seeking capital with established investors looking to provide it.

Alternative lenders typically offer more flexible payment terms, and you don’t have to jump through hoops to qualify. You may even have the funds in hand as fast as 24 hours. Some examples of alternative loan solutions include a line of credit, quick cash loans, and equipment loans.

5. Do you have collateral?

Since alternative lenders make it easier for small business owners to access capital, they are not just going to risk lending the funds and hope for the best. To reduce the chance of non-repayment, lenders often request collateral to back the loan.

Collateral is a large ticket item, like a car or home, that is pledged as security for repayment of a loan. The item transfers to the lender in the event of a default. Lenders often request it so that they can recoup their funds one way or another. You can expect to provide collateral for business loans over a certain amount, so it is important to keep this in mind when applying.

6. Are my credit ratings strong enough?

Lenders will consider both your personal and business credit reports to ensure you are credit worthy. Your personal credit score is a three-digit summary, which provides an overview of your spending behavior.

The same goes with a business credit score, which is a number between 0 and 100. It helps confirm that you have the ability to pay for your business expenses in a timely manner.

Generally, a good personal credit score should be at least 680. For businesses, a good score is 700 and above. Having strong credit scores shows you are less of a risk, which makes you a strong candidate for a loan with better terms and a lower interest rate.

Commonly Asked Questions

Can you be personally liable for business debt?

If your business fails, paying the debt is your responsibility as the owner. In this circumstance, you could find yourself going into debt for a business that has closed its doors.

Can I use this program to take care of both business and personal debt?

Absolutely. Our debt coaches take a holistic approach before they customize a solution that fits your overall needs and budget.

Our program is designed to help small business owners pay off their debt and get their business back on track as quickly and inexpensively as possible. Depending on your situation, we can help you with compassionate credit counseling, cost-effective debt consolidation loans, bankruptcy referrals, and other options.

What are my fees?

We don’t get paid until your debts are settled. Our fee is based on the state you live in, ranges from 15%-25% of your enrolled debt, and is built into your monthly payments. In the end, you will still pay less than what you originally owed.

What is your track record?

We have been helping people and businesses pay off their debt since 2009. We are A+ rated and fully accredited with the Better Business Bureau. In addition, we have over 75,000 5-star reviews from satisfied clients.

All You Need To Know

We’ve put all of our essential resources in one spot. Everything from debt resolution to taking control of your financial future . Need to talk? Our experts are here to help. Call us anytime for a free no-obligation consultation.

Pay off your business debt

- Receive A Free Savings Estimate Today

- See How Quickly You Can Be Debt Free

- No Fees Until Your Accounts Are Settled

Essential Reading

The latest debt relief news, tips, and resources from our team.

We’ve transformed the lives of more than 500,000 people

“The anxiety is gone, I am credit card debt-free. And that right there, I never thought I would be able to say those words, and it just feels so good.”

Michelle saved 23% on her debt

Now I’m able to go on vacation for the first time in a long time- I was able to go and relax. I couldn’t do that before.

Now I wake up knowing that I am paying off my debt, it’s like a weight lifted off my chest and I can breathe a bit more.

“The anxiety is gone, I am credit card debt-free. And that right there, I never thought I would be able to say those words, and it just feels so good.”

Michelle saved 23% on her debt

Now I’m able to go on vacation for the first time in a long time- I was able to go and relax. I couldn’t do that before.

Now I wake up knowing that I am paying off my debt, it’s like a weight lifted off my chest and I can breathe a bit more.

“The anxiety is gone, I am credit card debt-free. And that right there, I never thought I would be able to say those words, and it just feels so good.”

Michelle saved 23% on her debt

Now I’m able to go on vacation for the first time in a long time- I was able to go and relax. I couldn’t do that before.